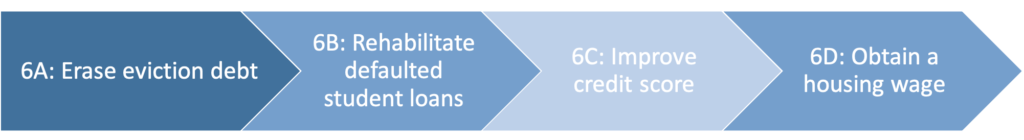

Click on a Step below for details:

6A: ERASE EVICTION DEBT

6A.1: Help your client obtain his/her free credit report. Eviction debt is usually found in a separate rental history report that can be obtained through a credit screening company. Evictions do not normally show up on credit reports, but any eviction debts sold to a collection agency may remain on the credit report for up to 7 years. Positive rental payment history may also be included in the credit report. Your client must investigate to find out if their eviction debt has been sold to a collections agency or is still in the hands of the landlord.

Help your client obtain his/her free credit report, learn how to read a credit report, and review it for discrepancies. A realistic target score is 640 because that is the minimum score to be eligible for down-payment assistance if the client chooses to purchase their own home. The higher the score, the better the chances of credit approval. Improving this score will be an ongoing goal.

ACTION: Request free credit report

RESOURCE: freecreditreport.com (No Credit Card Needed) or Annual Credit Report.com – Home Page

ACTION: Find out credit score

ACTION: Review eviction debt

RESOURCE: How to read a credit report

RESOURCE: Clark Howard | How to dispute an error on your credit report and win

RESOURCE: How long does an eviction stay on your record?

RESOURCE: What is a good credit score?

RESOURCE: MMI | Ultimate Guide to Rebuilding Your Credit

6A.2: With your client go over the newly developed budget to see where spending can be curbed and income increased to free up money to pay off the eviction debt.

ACTION: Target the EITC (Earned Income Tax Credit) if feasible to pay down debt.

RESOURCE: EITC, Earned Income Tax Credit

ACTION: Use VITA (Volunteer Income Tax Assistance) if feasible.

RESOURCE: VITA: What is it

ACTION: Make an appointment with MMI at the Hispanic Center for Financial Excellence to learn how to get a landlord or creditor to accept a lower lump sum to pay off the debt. “I don’t have any money. Can we work something out?” Talk with the landlord/creditor. Be sure to get the payment plan in writing.

RESOURCE: 1-877-705-3167 or Schedule Appointment with Clearpoint

RESOURCE: Removing eviction debt from credit report

RESOURCE: How to remove an eviction record

ACTION: Have your client consider getting an additional part time job to pay off the eviction debt.

RESOURCE: How to Increase Your Income With A Side-Gig

RESOURCE: Ultimate Guide to Earning Extra Income in the Gig Economy | MMI

ACTION: Identify expenses that can be reduced to pay off debt

RESOURCE: See Step 5: Building Savings

6B: REHABILITATE DEFAULTED STUDENT LOANS

If your client is in default on student loans, rehabilitate the loan asap. Otherwise, try to reduce the amount of payment to a level low enough that the client can make consistent on-time payments. Most property owners do not consider student debt or medical debt during the application process. It does become an issue, however, if the client is in default. If they are in default on their loan the client’s income or EITC can be garnished. After 270 days of non-payment, a student loan is in default and can be transferred to a collection agency. It takes 10 months of on time payments to move the loan from default to active so this needs to be a high priority. Consult with a VITA counselor to see if it is advisable to ask for an income tax extension to give the client 10 months of on time payment history.

6B.1: Student loans affect the client’s credit report and credit score. Missed payments is the most common reason for a low credit score. If they are having trouble making their payments because of low income, the client can renegotiate a lower monthly payment-sometimes as low as $5 a month and still be considered current on their loan.

6B.2: Try to avoid default. Try to avoid loans in default because the consequences can be devastating from wage garnishment, to plummeting credit score to being sued.

ACTION: Review loan documents, seek counseling from MMI

ACTION: Review loan documents, seek counseling from MMI

RESOURCE: 1-877-705-3167 or Schedule Appointment with MMI/Clearpoint

6B.3: Clients should never pay an outside company for help in this area as all the necessary information is available for FREE.

6B4: If your client’s student loan is in default, they have 3 options:

6B4a: Loan rehabilitation

RESOURCE: M2H Student Loan Info Loan Rehabilitation

6B4b: Loan consolidation

RESOURCE: M2H Loan Consolidation

Contains information about:

– income based

– pay-as-you-earn

– public service loan forgiveness

– civilian employees

– health care workers

– volunteers

6B4c: Repayment in full

6B4d: Additional resources

RESOURCE: MMI resources on student loan debt

RESOURCE: Manage Loans

RESOURCE: Clark Howard’s student loan guide

RESOURCE: Credit report monitoring and repair

RESOURCE: 5 sneaky ways to improve your credit score

RESOURCE: 9 reasons your credit score dropped

6C: IMPROVE CREDIT SCORE

6C1: Property owners will review your client’s credit score to assess the likelihood that they will pay their rent in full and on time. Therefore, it’s important that they do everything they can to raise their credit score. If they have recently paid off some accounts and those accounts have not been removed from their credit report have them show that information and the supporting documentation to the leasing agent at the time of their application.

6C2: For more information, please see Step 7: Understanding and Improving Your Credit Score

6D: OBTAIN A HOUSING WAGE

6D1: The Housing Wage is a calculation produced by the National Low Income Housing Coalition. In Georgia, the housing wage for a 2 bedroom apartment is $19.11/hour or $39,758 per year. If your client is earning less than this amount they are “cost-burdened” and are unlikely to be successful at maintaining stable housing.

RESOURCE: Out of Reach 2020: Georgia

RESOURCE: See Step 8: Increase Income