Motel 2 Home Process

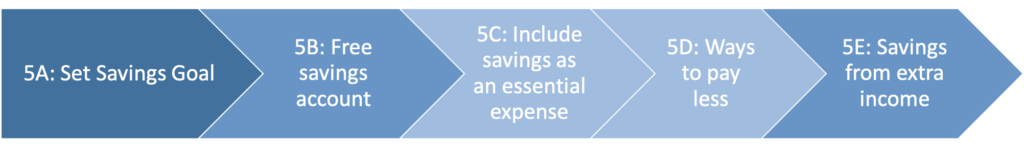

Step 5: Building Savings

Most of our clients have little or no savings. For many of them, it was an unexpected emergency that left them without money to pay their rent and led to their eviction. They are not alone as the Federal Reserve has found that almost 40% of American adults would not be able to cover a $400 emergency bill.

We all need emergency savings. Establishing a savings habit is a goal of the M2H program and we are putting our money where our mouth is! Clients are expected to save $50 per month which will be matched after successful completion of the program so that they will have $1000 in emergency savings when they leave the program and begin to enjoy financial security.

Click on a Step below for details:

5A: SET SAVINGS GOAL

We expect a minimum of $25 per month for 12 months for an emergency savings fund. This will be matched 1:1, up to $600 (if more is saved) when they exit the program. If your client does not complete the program, they will of course get their savings back but they will not receive the matching funds. Because we want to establish a savings habit, the money must be deposited monthly-not all in one lump at the end. It is ok if your client may have additional savings goals greater than $25/month but be sure they are also addressing their debt. Please make it clear that only the first $600 saved will be matched.

ACTION: Have client set a savings goal

RESOURCE: Building Savings | Free Online Financial Education Webinars |MMI

RESOURCE: MMI Building Savings Workbook (PDF)

RESOURCE: The #1 secret to money success | Follow this rule to always stay ahead of your finances!

RESOURCE: Emergency savings | Because life is unpredictable, and you need to be prepared for it

5B: FREE SAVINGS ACCOUNT

Each client will be given a free savings account through xxx Credit Union. Clients can make xxx (electronic or physical? ) deposits directly into their account. Deposits will be verified monthly by the caseworker.

5C: INCLUDE SAVINGS AS AN "ESSENTIAL" EXPENSE

But I don’t have enough money to save! This is a frequent response from clients who do indeed struggle just to pay the bills. To find more money for savings help them find ways to pay less for some of the things they already purchase through reduced pricing of:

RESOURCE: MMI | The Ultimate Guide to Saving Money on Groceries

RESOURCE:MMI | The Ultimate Guide to Saving on Car Insurance

RESOURCE: MMI | The Ultimate Guide to Finding Affordable Medications – MMI Budget Guide

RESOURCE: SVdP Pharmacy: If your client uses maintenance drugs for a chronic condition, consider referring them to the SVdP Community Pharmacy for drugs mailed to them at no charge. Further information can be found on the SVdP Georgia Community Website: www.svdpgeorgia.org/pharmacy.

RESOURCE: MMI | The Ultimate Guide to Cutting Cable (and Staying Entertained)

RESOURCE: MMI | The Ultimate Guide to Reducing Your Cellphone Bill

RESOURCE: 54 Ways to Save Money | America Saves

5E: SAVINGS FROM EXTRA INCOME

Another source for savings can be from extra income obtained through a “side-gig”.

RESOURCE: Ultimate Guide to Earning Extra Income in the Gig Economy | MMI

RESOURCE: How to Make Extra Money: 23 Easy Ways