Motel 2 Home Process

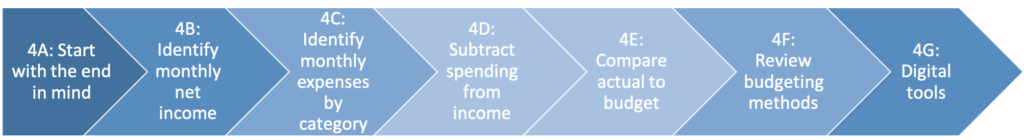

Step 4: Prepare a Budget

The first step in helping clients achieve financial stability is to help them prepare a budget and track expenses so they know where their money is going. Most clients are surprised to see how much they are spending in different expense categories. This healthy financial habit implemented monthly will help them achieve their financial goals by being more intentional about where they spend their money. Creating a budget and tracking monthly expenses is a required activity of the M2H Program.

Many of the resources below and in subsequent steps will have overlapping content. When learning new material it is helpful to hear new concepts presented in different ways. A schedule of in-person workshops and live webinars will be added to the website as they become available.

Click on a Step below for details:

4A: START WITH THE END IN MIND

Talk with your client about their goals. For most of them, it will be to achieve stable housing but they may have other goals as well. Have your client write down their financial goals and be as specific as possible knowing that these goals may need to be adjusted. Next, review the educational materials below explaining the budgeting process. Have your client identify the budget method that will work best for them and then help them stick with it on a monthly basis.

ACTION: Have client write down financial goal(s)

RESOURCE: MMI Setting Goals and Priorities Handout (PDF)

RESOURCE: MMI Setting Goals Priorities Goal Map Worksheet(PDF)

RESOURCE: MMI Priorities Goals Income Expenses Participant Handout (PDF)

RESOURCE: How to Manage Money and Credit in Order to Save | Free Online Financial Education Webinars |MMI

4B: IDENTIFY MONTHLY NET INCOME

This includes income from all sources including child support, alimony, SSI, SSDI, etc.

4C: IDENTIFY MONTHLY EXPENSES BY CATEGORY

Help client categorize spending items into 3 categories:

- “essential” expenses (includes savings)

- “wants”

- “periodic” expenses

It’s important to track every dollar and so talk with your client about how they will collect their receipts/expenses. Some clients log each expense in on their phone, others put them in a bag or envelope they keep in their car.

RESOURCE: MMI Managing Income and Expenses Workbook (PDF)

RESOURCE: MMI Budget Worksheet (PDF)

RESOURCE: Record of Daily Expenditures

RESOURCE: MMI Income-expense Worksheet (PDF)

RESOURCE: 12-Month Budget Worksheet (PDF)

4D: SUBTRACT SPENDING FROM INCOME

Any money left over should be added to savings!

4E: COMPARE ACTUAL TO THE BUDGET

RESOURCE: The Budget Mom: Budget vs. Your Actual Spending (Video)

4F: REVIEW BUDGETING METHODS

MMI suggests several to choose from: 50/30/20; Zero Sum; Anti-budget; and Money Flow. Review the different methods with your client and have them choose the one that will fit their goals and personality.

ACTION: Have client choose a budgeting method

4G: DIGITAL TOOLS

A complete description of each of these online tools can be found in the above resource: Ultimate Guide to Creating a Budget